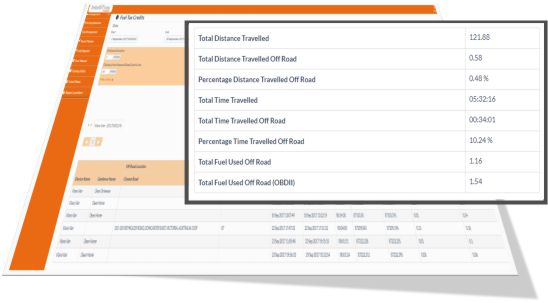

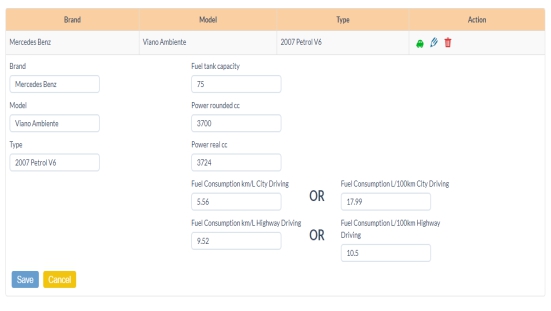

Fuel tax credits are credits for the fuel tax (excise or customs duty) that's included in the price of fuel. Most businesses are entitled to fuel tax credits for fuel used in a range of business activities, excluding the use of light vehicles on public roads. The rate of credit varies according to the use to which the fuel is put.

Fuel tax credits provide businesses with a credit for the fuel tax (excise or customs duty) that's included in the price of fuel used in:

- Machinery

- Plant

- Equipment

- Heavy vehicles

- Light vehicles travelling off public roads or on private roads.

The amount depends on when you acquire the fuel, what fuel you use and the activity you use it in. Fuel tax credits rates also change regularly so it's important to check the rates each time you do your business activity statement (BAS).

Some fuels and activities are not eligible including fuel you use in light vehicles of 4.5 tonnes gross vehicle mass (GVM) or less, travelling on public roads.

Detailed official information is available directly from The Australian Taxation Office Fuel Tax Credits Website.